Introduction

In the complicated world of personal finance, loans play a significant part in helping people achieve their goals. Whether it’s getting a home, starting a business, or seeking higher education, loans provide the necessary funds.

However, it’s crucial to understand the factors that can cause your loan amount to grow, possibly leading to financial strain. In this thorough guide,

we will dig into the various elements that add to a growing loan amount, including interest, fees, and fines. We’ll also study tactics to avoid these rises and provide real-world cases to explain these ideas.

Factors That Increase Your Loan Balance

Interest Rates

Interest rates are at the heart of every loan. They indicate the cost of getting money and are a crucial factor in determining the overall cost of a loan. Understanding how interest rates work is vital to controlling your loan amount successfully.

Compound Interest

Interest rates are usually multiplied, meaning they are figured not only on the original capital but also on any collected interest. This compounding effect can significantly increase your loan amount over time. The higher the interest rate and the longer the loan time, the more you’ll pay in interest.

Example: Consider a $10,000 loan with a yearly interest rate of 5%. In the first year, you’ll pay $500 in interest. However, in the second year, you’ll pay interest not just on the $10,000 capital but also on the $500 interest from the first year, resulting in a higher total interest payment.

Fixed vs. fluctuating interest rates

Some loans have set interest rates that stay unchanged throughout the loan period. Others have flexible rates, which can vary based on market factors. Variable rates can make it difficult to predict future interest costs, possibly causing your loan amount to grow suddenly.

Tip: If you prefer security in your loan payments, opt for a fixed-rate loan.

Fees and Charges

Lenders often place various fees and charges that can lead to an increasing loan amount. These fees can change based on the type of loan and the lender’s rules. Here are some usual fees to watch out for:

Origination Fees

Origination fees are charges applied by lenders to cover the cost of processing a loan application. They are usually stated as a fraction of the loan amount. These fees are generally taken from the loan amount, which means you’ll receive less money upfront.

Late payment fees

Late payment fees are charged when you fail to make a payment on time. These fees can be steep and can quickly add to your loan amount. It’s crucial to understand your loan’s grace time and due dates to avoid late fees.

Prepayment Penalties

Some loans come with prepayment fines, which are fees applied if you pay off your loan before the agreed-upon time. While it may seem illogical, these fines can discourage borrowers from making extra payments to lower their loan amount.

Tip: When looking for loans, compare the fee systems of different lenders to find the most suitable terms.

Penalties

Penalties are charges imposed when you break the terms of your loan deal. They are usually meant to stop late payments and failures. Understanding the fines linked to your loan is important to avoid unnecessary increases in your loan amount.

Late payment fees

Late payment fines are applied when you miss a planned payment. They are generally stated as a fraction of the delayed amount. The longer you delay payment, the more important the punishment becomes.

Default Penalties

Defaulting on your loan by regularly failing to make payments can have serious effects. In addition to late payment fines, failure can lead to court action, ruined credit, and a growing loan amount due to extra interest.

How to Avoid an Increasing Loan Balance

Understanding the reasons that lead to a growing loan amount is important, but it’s equally crucial to know how to avoid such situations. Here are some methods to help you keep your loan amount in check:

Make Timely Payments

The easiest and most effective way to prevent your loan amount from growing due to fines and late fees is to make your payments on time. This takes careful planning and financial control. Here’s how you can achieve this:

Set up payment alerts.

Leverage technology to your advantage by setting up payment reminders on your phone or computer. Many lenders also offer automatic payment choices, ensuring you never miss a due date.

Create a payment plan.

Maintain a payment schedule that shows all your loan due dates. Having a clear sign of when each payment is due can help you plan your funds properly.

Emergency Fund

Building an emergency fund can provide a financial safety net in case unexpected costs appear, keeping you from missing loan payments.

Pay More Than the Minimum

Paying only the minimum necessary amount on your loans may seem easy, but it can lead to an ever-increasing loan debt. Whenever possible, try to pay more than the minimum to speed your debt payback and lower interest costs. Here’s how:

Make biweekly payments.

Instead of making monthly payments, try making half of your monthly payment every two weeks. Over a year, this adds up to an extra payment, helping you pay off your loan faster.

Allocate Windfalls

Whenever you receive surprise windfalls, such as tax returns or bonuses, consider using a part of that money to make extra loan payments. This can have a big impact on lowering your loan amount.

Apply Lump-Sum Payments

If you come across a large sum of money, like a gift or a work-related bonus, consider using a part of it to pay down your bills.

Refinance Your Loan

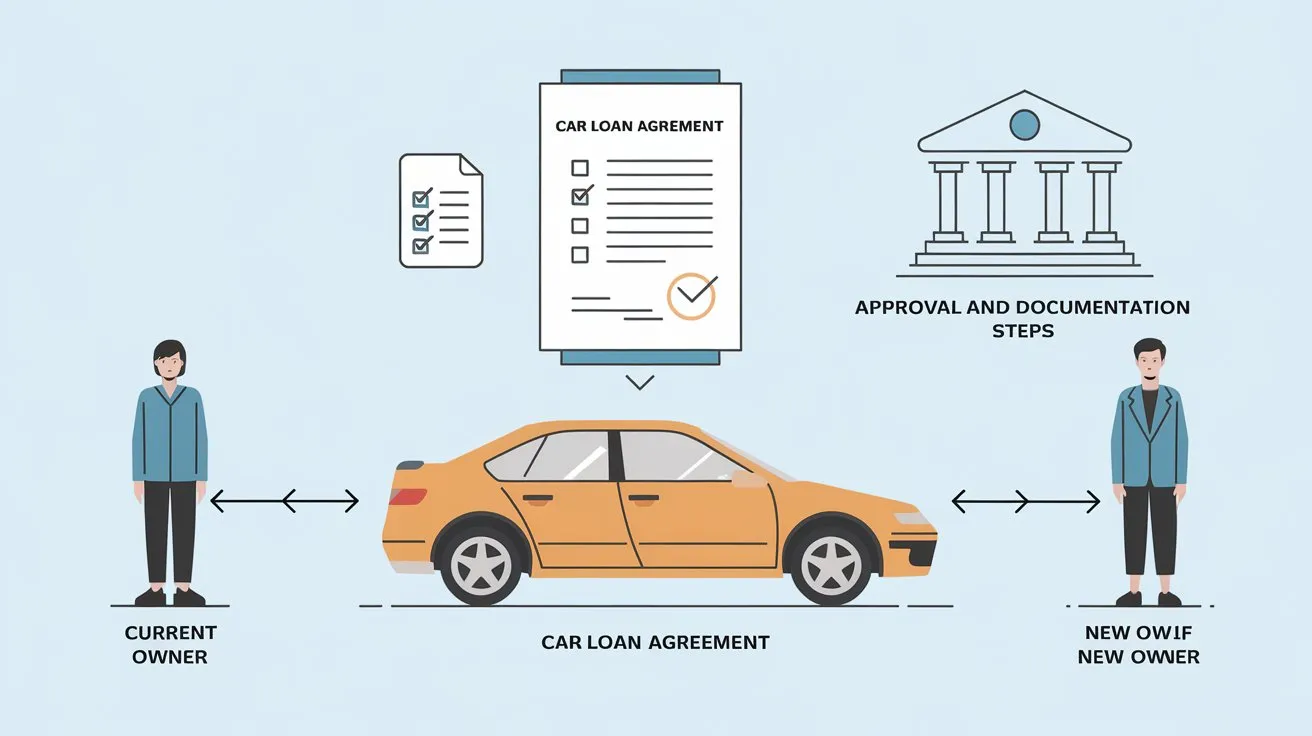

Refinancing your loan includes replacing your current loan with a new one that has more favorable terms. This can be an effective approach to reducing your loan amount if you can achieve a lower interest rate. Here’s how it works:

Lower Interest Rate

Refinancing allows you to receive a loan with a lower interest rate, which can greatly reduce your monthly payments and the total interest paid over the life of the loan.

Shorten the loan term.

You can choose a shorter loan time when refinancing, which will result in higher monthly payments but a faster payback. This can help you lower your loan amount more quickly.

Example: Sarah’s Car Loan (Continued) Returning to Sarah’s car loan case from earlier, after changing to a lower interest rate, she cuts her monthly payment. However, she continues to make payments at the same amount as before, giving the extra money to the capital. As a result, she pays off her loan faster, avoiding further interest collection and stopping her loan amount from growing.

Tips for Reducing Your Loan Balance

While avoiding a growing loan balance is important, constantly working to lower your loan balance is equally crucial for achieving financial freedom. Here are some useful tips to help you lower your loan amount effectively:

Create a Budget

A well-structured budget is the basis of sound financial management. It allows you to allocate a part of your income to loan repayments while paying your basic living costs. Here’s how to make a budget:

List your income.

Start by naming all your sources of income, including your pay, contract work, and any other income lines.

Track your spending.

Record all your monthly costs, including rent or mortgage, utilities, food, transportation, and extra spending like entertainment.

Allocate for loan payback.

Determine how much you can comfortably put towards loan repayments while still meeting your other financial responsibilities.

Stick to your limit.

Once your budget is set, stick to it carefully. Adjust it as needed to handle changes in your income or spending.

Use windfalls wisely.

Windfalls are sudden cash increases, and how you use them can greatly impact your loan amount. Here’s how to make the most of windfalls:

Prioritize debt payments.

Consider giving a part of any gain, such as a tax return or a monetary gift, toward paying down your bills.

Emergency Fund

If you don’t have an emergency fund, use windfalls to create one. Having an emergency fund can protect you from taking on more debt when unexpected costs appear.

Invest Wisely

Depending on the size of the gift, consider putting it in assets that can grow over time, such as stocks or savings accounts. Earning a return on your money can help offset the interest costs of your loans.

Explore Debt Consolidation

Debt consolidation involves combining multiple loans into a single, more doable loan. This can streamline your payments and possibly lower the interest rate on your loan. Here’s how it can help:

Lower Interest Rate

By combining your bills, you may qualify for a lower interest rate, lowering the overall cost of spending.

Simplified Payments

Having a single monthly payment instead of handling multiple bills can make it easier to stay organized and avoid missed payments.

Pay off high-interest debt.

Debt consolidation allows you to pay off high-interest debt, such as credit card bills, with a lower-interest loan.

Example: John’s Credit Card Debt (Continued) Returning to John’s position, he chooses to consolidate his high-interest credit card debt into a personal loan with a lower interest rate. This not only simplifies his payments but also lowers the total interest he pays, helping him pay off his debt faster and prevent his loan amount from growing further.

Examples

To get a better idea of how the concepts discussed in this guide work in real life, let’s study two real-world cases.

Example 1: Sarah’s Car Loan (Final Outcome)

Sarah plans to refinance her car loan to secure a lower interest rate. Her original loan had a yearly interest rate of 8%, resulting in a monthly payment of $202. After changing to a 5% interest rate, her monthly payment drops to $190. However, Sarah continues to pay $202 per month. As a result,

She pays off her car loan four months earlier than the original term.

She saves $194 in interest.

Her loan amount doesn’t grow, thanks to her extra payments.

This example shows how changing and making extra payments can help you lower your loan amount successfully.

Example 2: John’s Credit Card Debt (Final Outcome)

John consolidates his $15,000 credit card debt into a personal loan with a 10% interest rate, significantly lower than his credit card’s 18% interest rate. With a five-year loan term, John’s monthly payment is $318. He pledges to pay an extra $100 per month toward the principal. As a result,

John pays off his credit card debt five years earlier than if he had kept making minimum payments.

He saves $5,217 in interest.

His loan amount declines slowly, giving him financial relief.

This example shows the benefits of reducing high-interest debt and making extra payments to lower your loan amount.

Conclusion

Effectively controlling your loan amount is crucial for achieving financial safety and freedom. Understanding the reasons that add to a growing loan amount, such as interest, fees, and fines, allows you to make informed choices.

By adopting tactics like making timely payments, paying more than the minimum, and exploring debt reduction, you can actively work to lower your loan amount and achieve your financial goals.

The real-world examples given show that, with the right method, you can successfully prevent your loan amount from rising and eventually achieve financial peace of mind. Remember that financial success takes effort, focus, and a clear understanding of your debts and their terms.

Karthick Raja, MBA, is a personal finance educator and HR professional with 10+ years of experience in Personal Finance ,taxation, payroll, and career development. He helps readers build wealth, manage money wisely, and grow professionally.

2 thoughts on “What Increases Your Total Loan Balance: Tips to Avoid It”